43 how to calculate zero coupon bond

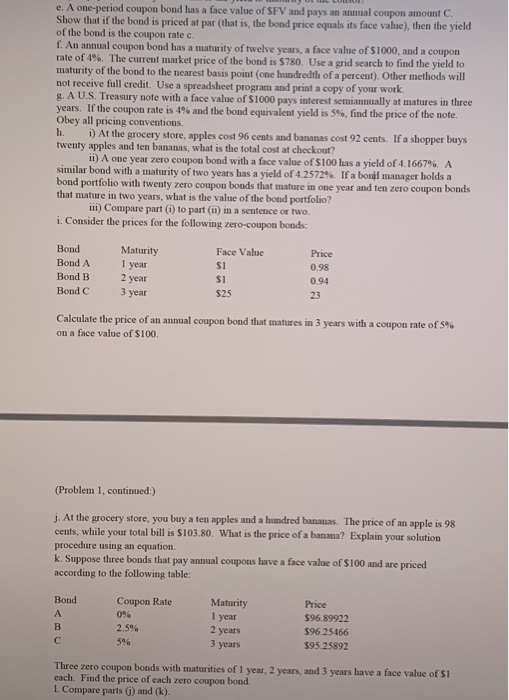

› ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · Calculating the Macaulay Duration of a Zero-Coupon Bond in Excel Fixed Income If I Buy a $1,000 Bond With a 10% Coupon, Will I Receive $100/yr Regardless of the Yield? › terms › zZero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

› documents › excelHow to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown.

How to calculate zero coupon bond

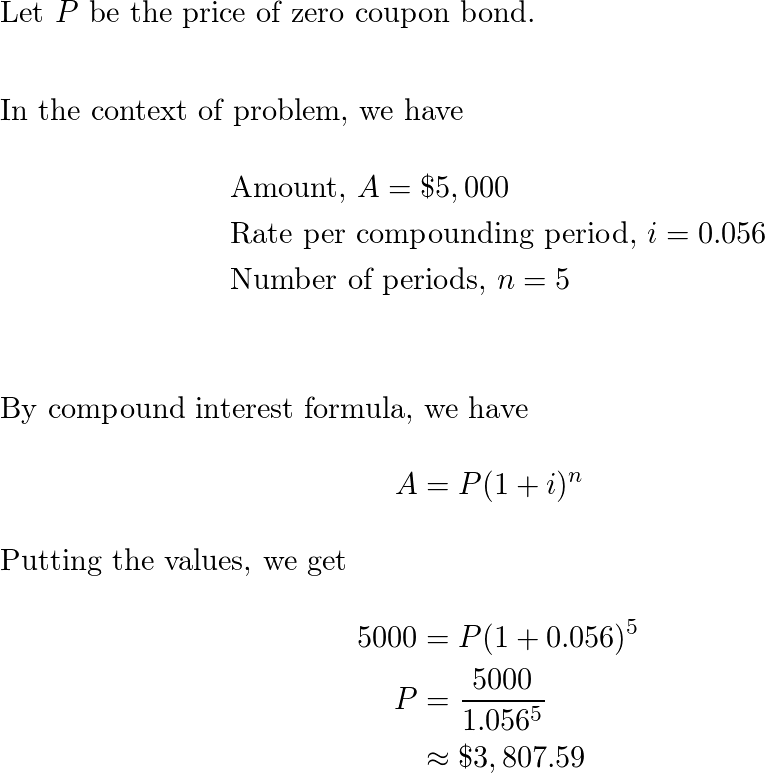

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind Sep 27, 2022 ... Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the ... › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

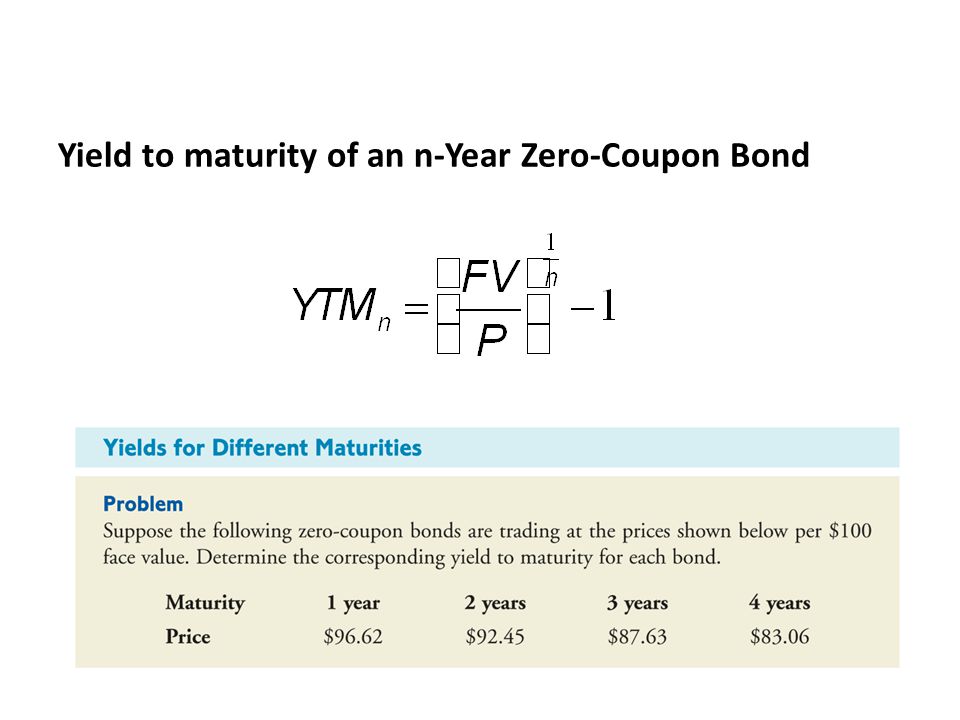

How to calculate zero coupon bond. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond ; Formula · PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) ; Model Assumptions. Face Value (FV) = $1,000; Number of Years to ... Zero Coupon Bond Value - Financial Formulas (with Calculators) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. › bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · n = 3 i = 10% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 3 Zero coupon bond price = 751.31 (rounded to 751) As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to ... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Calculating the Yield of a Zero Coupon Bond - YouTube Apr 13, 2015 ... This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to ... Zero-Coupon Bond - Definition, How It Works, Formula Pricing Zero-Coupon Bonds · Face value is the future value (maturity value) of the bond; · r is the required rate of return or interest rate; and ... Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 ... Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... Unlike the regular, coupon-paying bonds, a zero-coupon bond has an imputed interest rate (rather than an established interest rate). To ...

› ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind Sep 27, 2022 ... Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the ... › zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

:max_bytes(150000):strip_icc()/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)

Post a Comment for "43 how to calculate zero coupon bond"