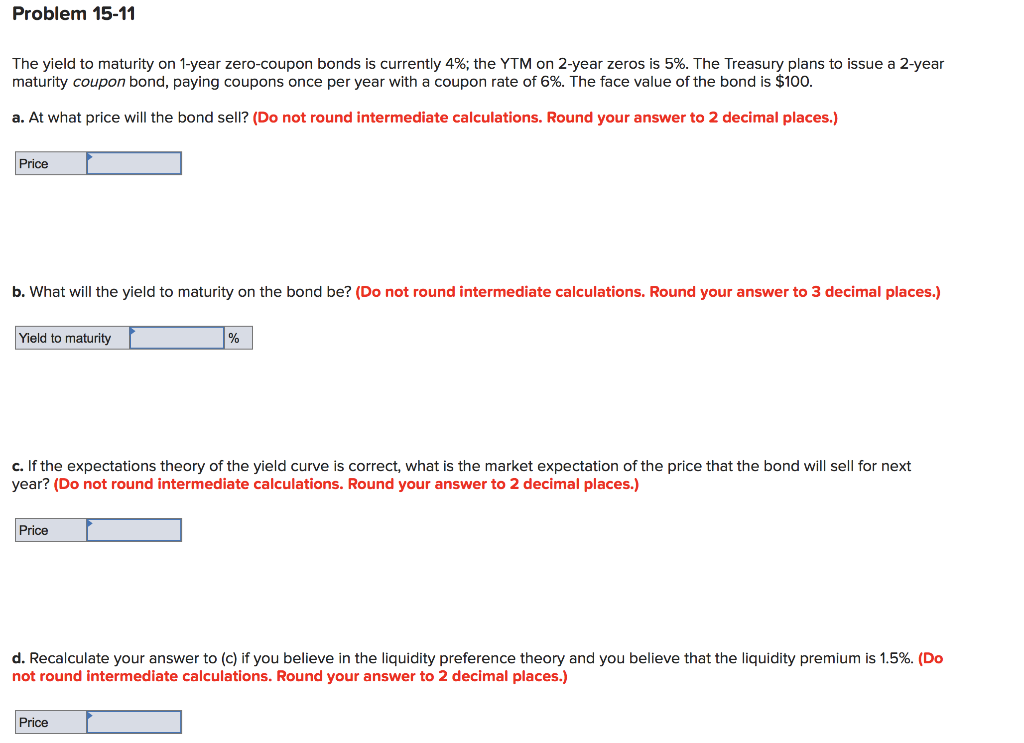

41 yield to maturity of coupon bond

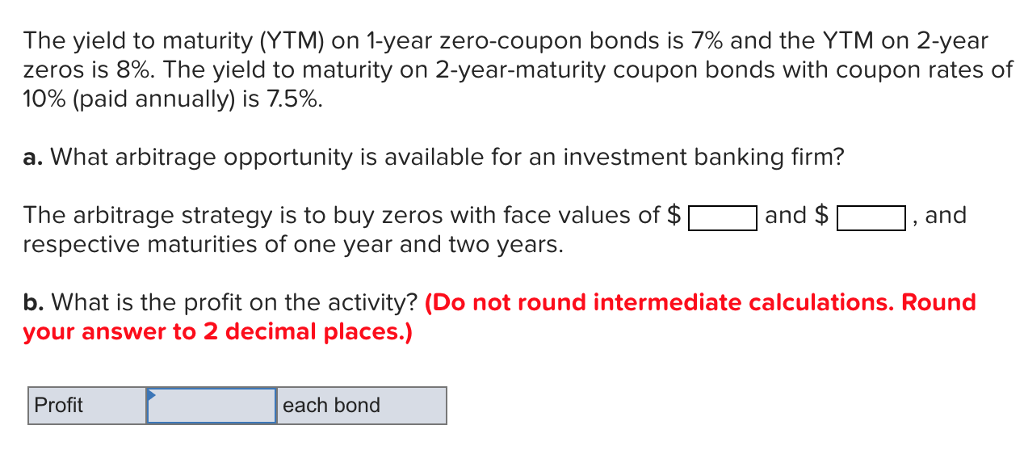

Yield to Maturity (YTM): Formula, Meaning & Calculation - ET Money But to simplify this, let us first consider what YTM means with respect to an individual bond. In the case of a Bond, YTM is defined as the total rate of return ... Yield to Maturity | Formula, Examples, Conclusion, Calculator Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or ...

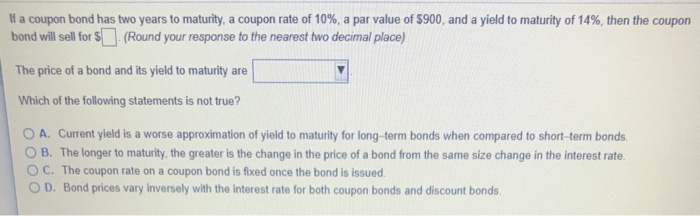

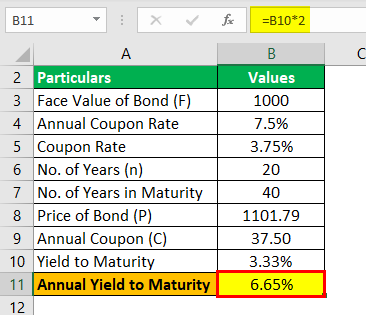

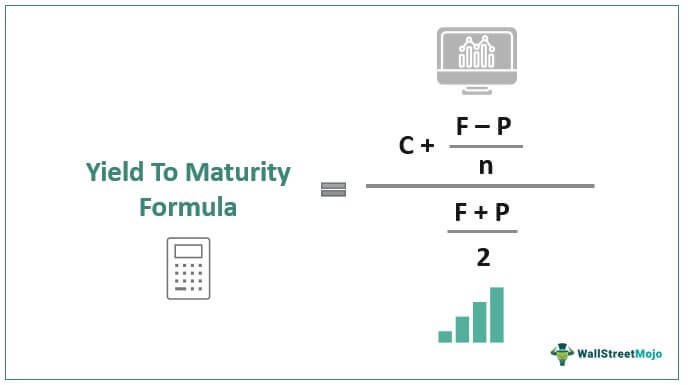

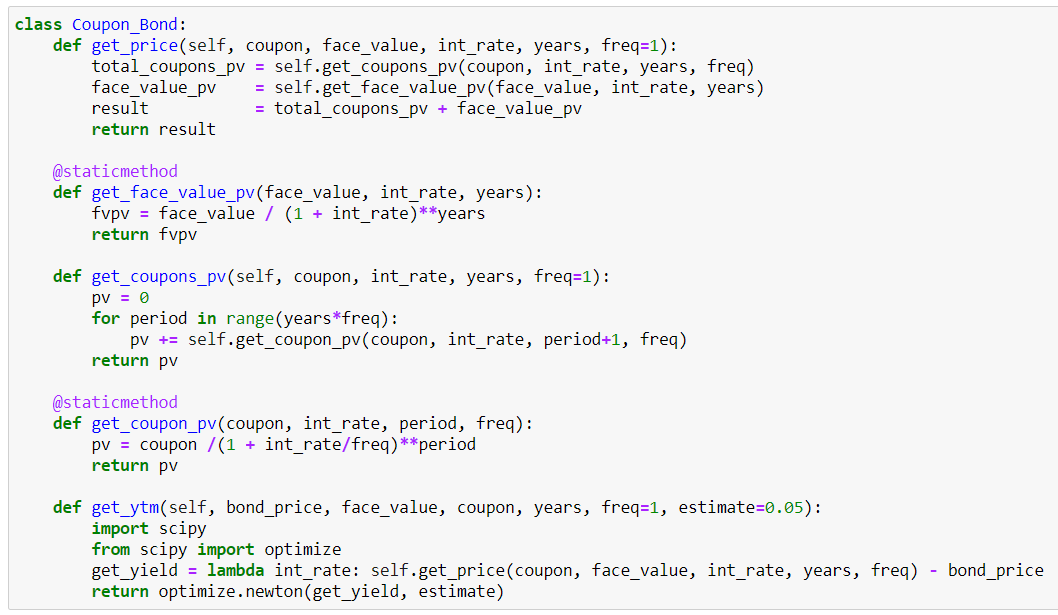

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples The current yield of bond= Annual coupon payment/current market priceread more, which measures the present value of the bond, the yield to maturity measures the ...

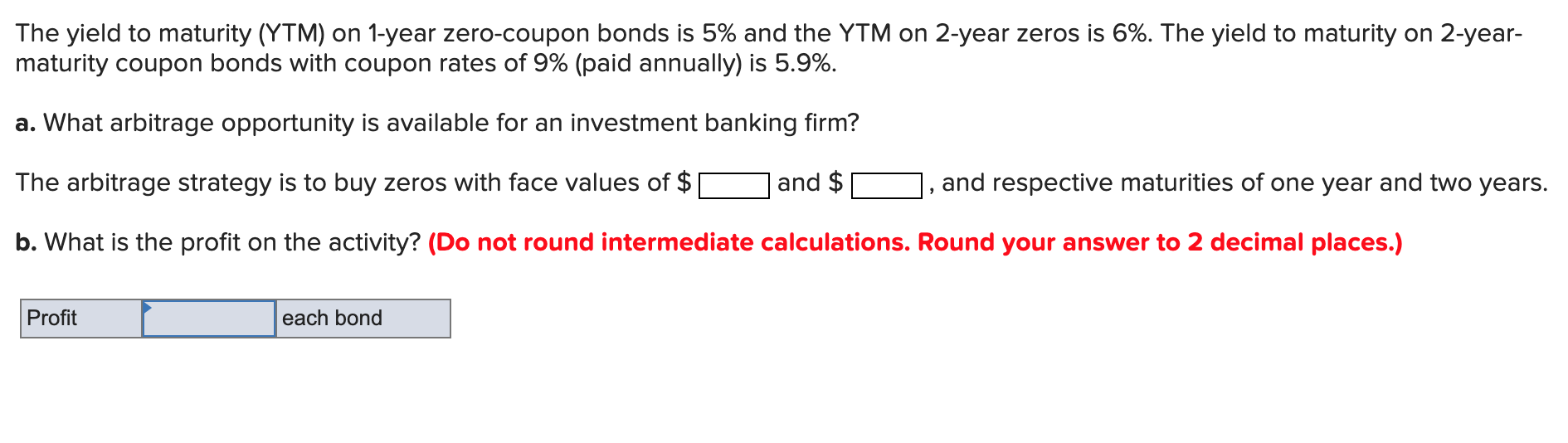

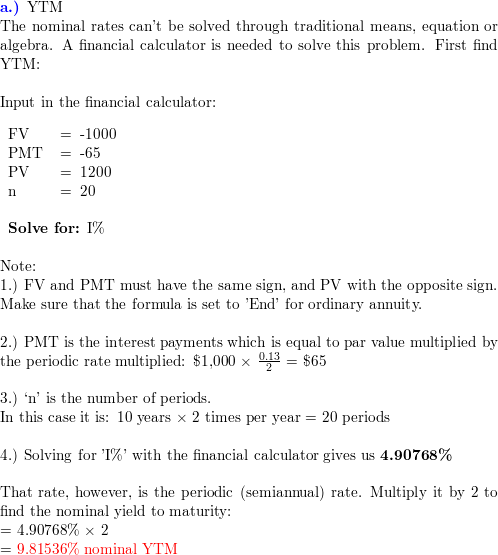

Yield to maturity of coupon bond

Yield to Maturity (YTM) - Overview, Formula, and Importance Oct 26, 2022 ... The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the ... Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon ...

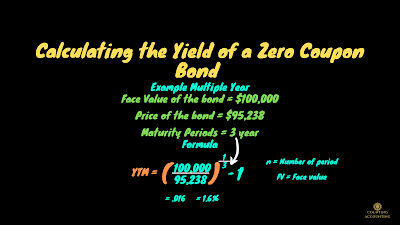

Yield to maturity of coupon bond. Yield to Maturity (YTM): Formula and Bond Calculation From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all ... Yield to Maturity – What it is, Use, & Formula - Speck & Company There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / ... Calculate Yield to Maturity of a Coupon Bond in 2 Minutes - YouTube Apr 30, 2022 ... Ryan O'Connell, CFA, FRM shows how to calculate yield to maturity (YTM) of a coupon bond. He uses a TI BA II Plus Calculator to calculate ... Yield to maturity - Fixed income - Robeco The yield to maturity (YTM) of a bond is the annualized return that a bond investor would receive from holding the bond until maturity.

Yield to Maturity (YTM): What It Is, Why It Matters, Formula A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon ... Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ... Yield to Maturity (YTM) - Overview, Formula, and Importance Oct 26, 2022 ... The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the ...

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

![PDF] Yield-to-Maturity and the Reinvestment of Coupon ...](https://d3i71xaburhd42.cloudfront.net/cd78b917effc5ad37eadf3dd6629e42e1a6f88f3/2-Figure1-1.png)

Post a Comment for "41 yield to maturity of coupon bond"