39 duration for zero coupon bond

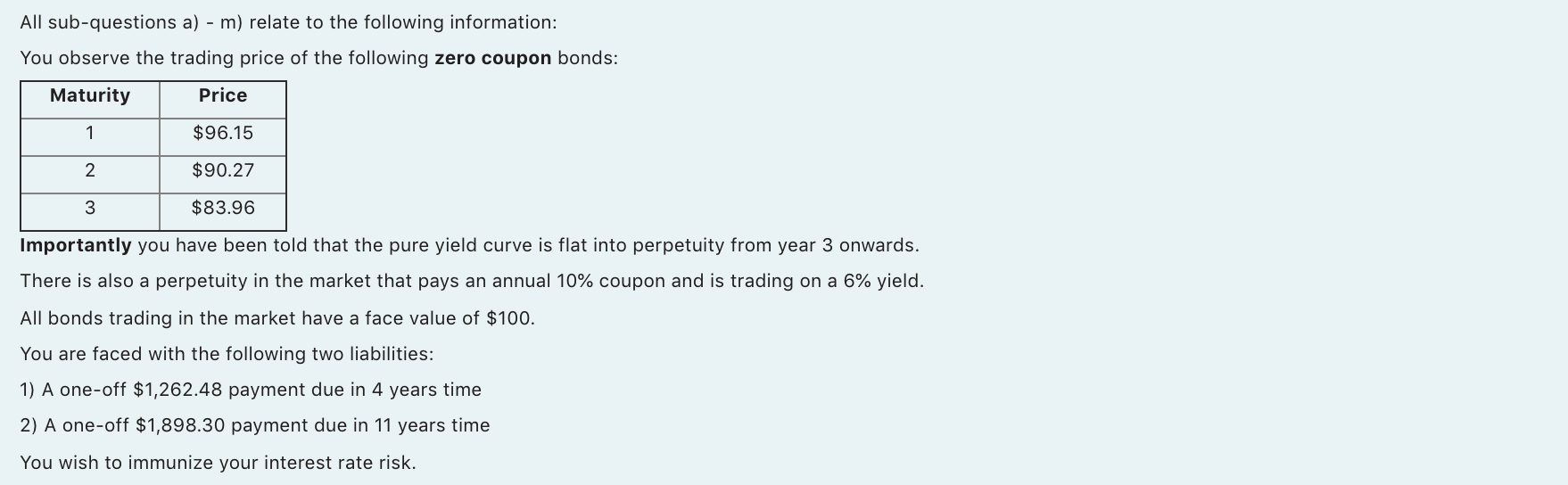

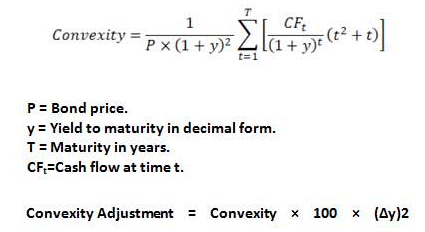

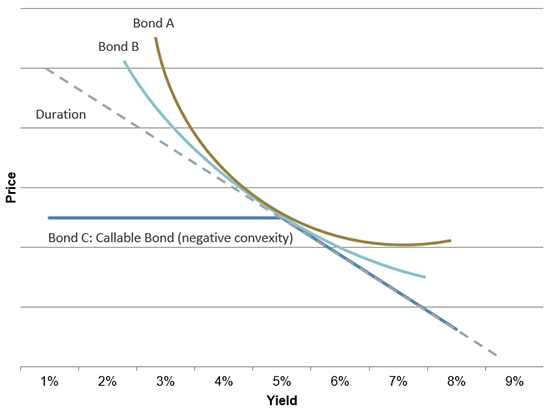

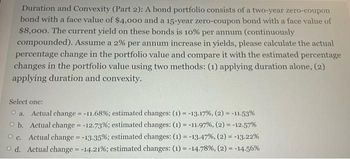

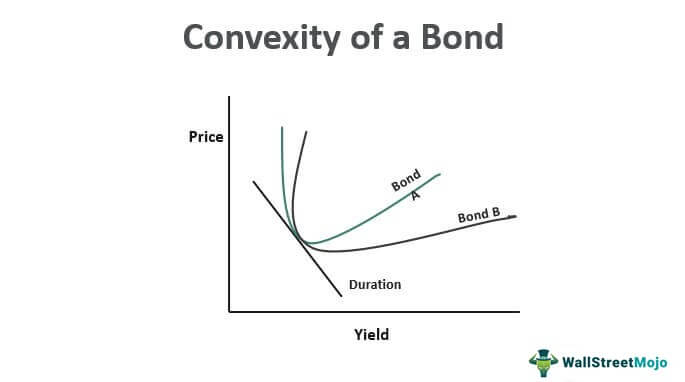

Zero Coupon Bond Calculator - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t; Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Convexity of a Bond | Formula | Duration | Calculation The duration of the zero-coupon bond which is equal to its maturity (as there is only one cash flow) and hence its convexity is very high While the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a ...

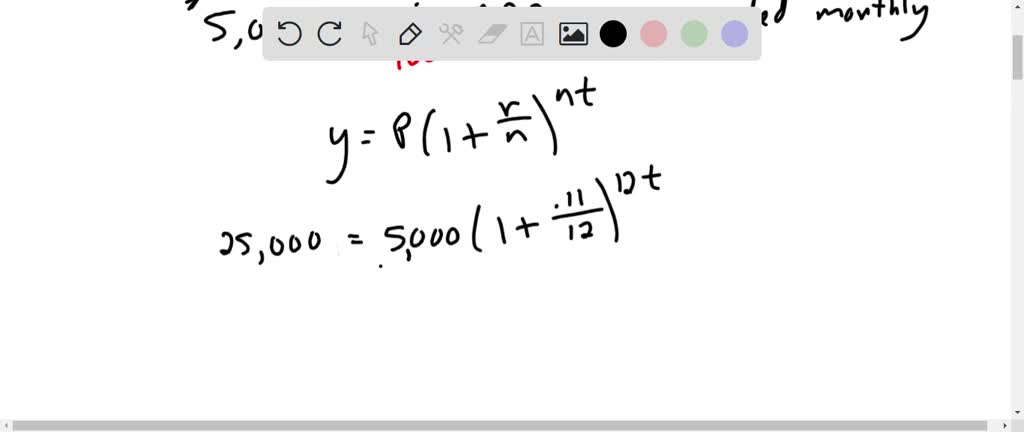

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

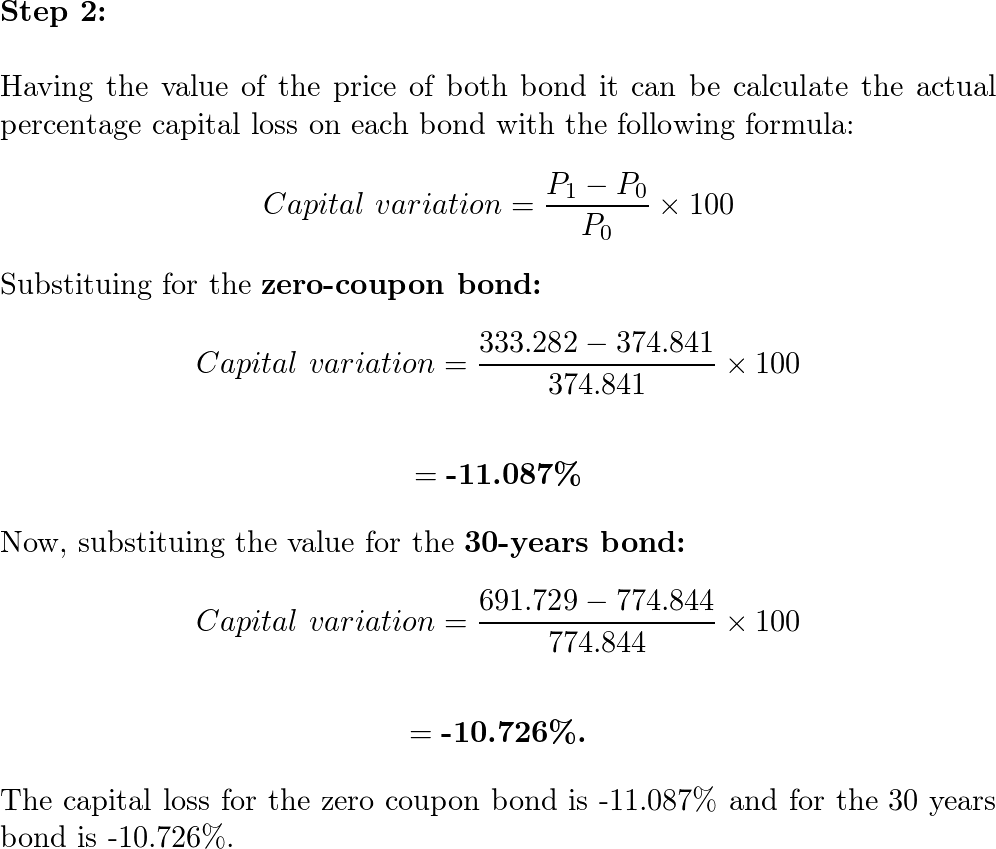

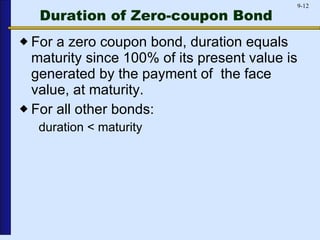

Duration for zero coupon bond

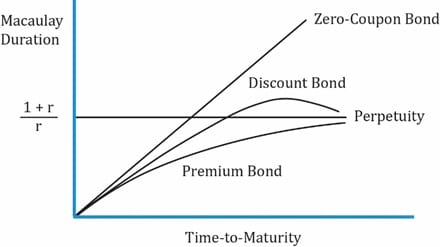

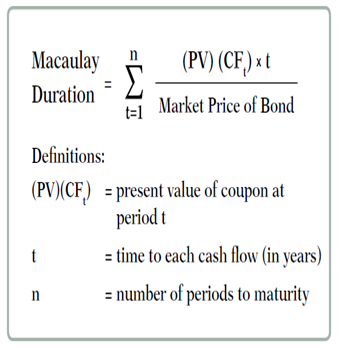

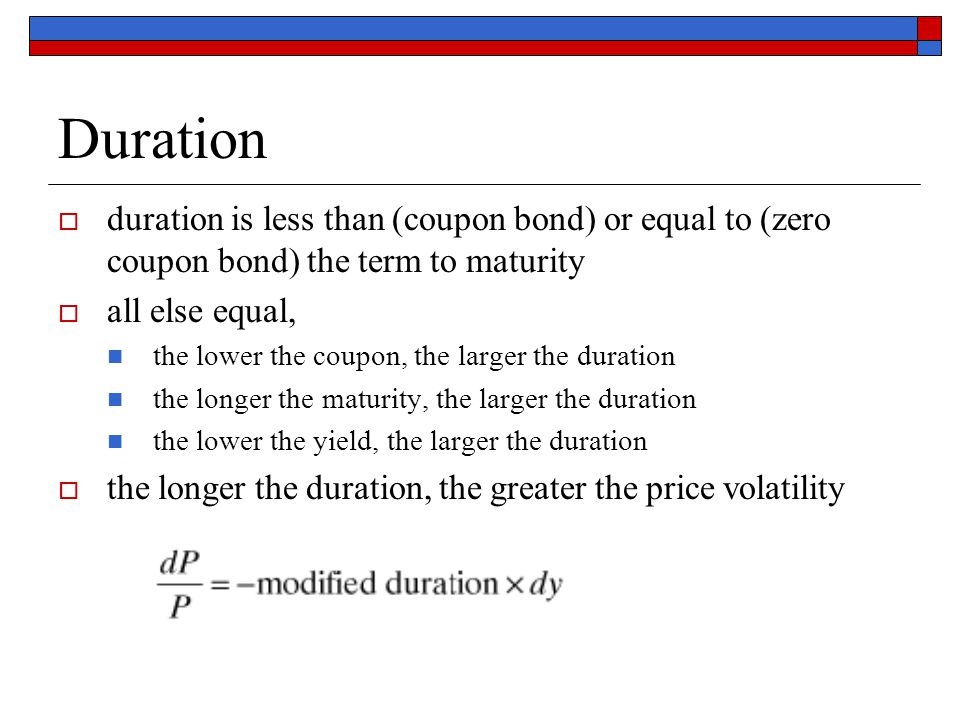

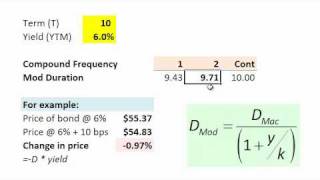

Bond valuation - Wikipedia Therefore, (2) some multiple (or fraction) of zero-coupon bonds, each corresponding to the bond's coupon dates, can be specified so as to produce identical cash flows to the bond. Thus (3) the bond price today must be equal to the sum of each of its cash flows discounted at the discount rate implied by the value of the corresponding ZCB. What Is the Macaulay Duration? - Investopedia Sep 29, 2022 · Macaulay Duration: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the ... The Macaulay Duration of a Zero-Coupon Bond in Excel Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount.

Duration for zero coupon bond. Bond duration: how it works and how you can use it - Monevator Oct 25, 2022 · What is bond duration? Bond duration expresses a bond’s vulnerability to interest rate risk. The larger the bond duration number, the more reactive a bond’s price is to interest rate changes, as the bond’s yield adjusts to reflect those changes. For example, if a bond’s duration number is 11, then it: The Macaulay Duration of a Zero-Coupon Bond in Excel Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount. What Is the Macaulay Duration? - Investopedia Sep 29, 2022 · Macaulay Duration: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the ... Bond valuation - Wikipedia Therefore, (2) some multiple (or fraction) of zero-coupon bonds, each corresponding to the bond's coupon dates, can be specified so as to produce identical cash flows to the bond. Thus (3) the bond price today must be equal to the sum of each of its cash flows discounted at the discount rate implied by the value of the corresponding ZCB.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

Post a Comment for "39 duration for zero coupon bond"