38 suppose you bought a bond with an annual coupon of 7 percent

Answered: suppose you bought a $1,000 face value… | bartleby Business Finance Q&A Library suppose you bought a $1,000 face value bond with a coupon rate of 5.6 percent one year ago. the purchase price was $987.50. you sold the bond today for $994.20. if the inflation rate last year was 2.6 percent, what was your exact real rate of return on this investment? Suppose you bought a bond with an annual coupon of 7 percent one year ... answered • expert verified Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a.Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b.What was your total nominal rate of return on this investment over the past year?

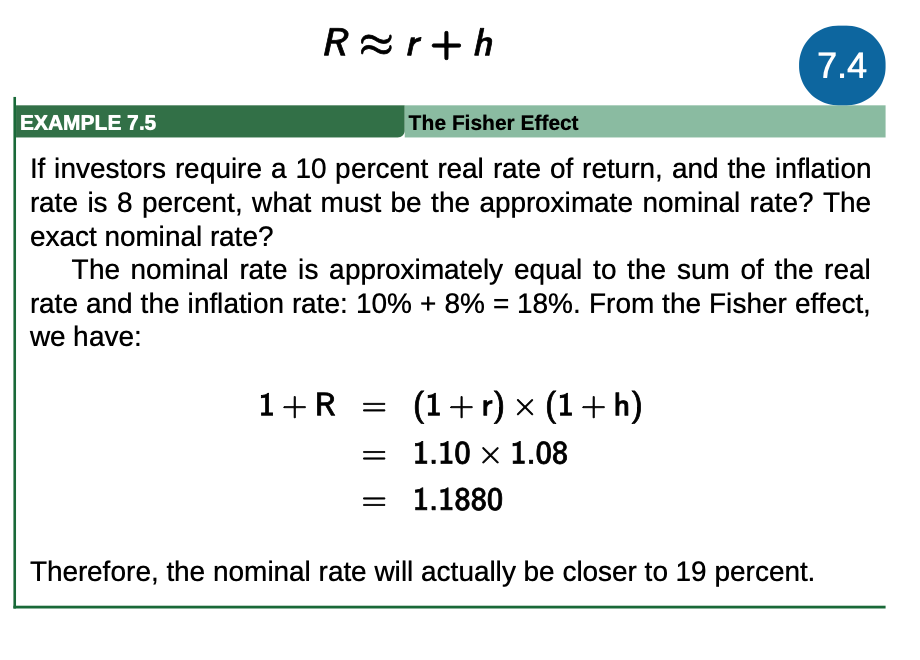

Chapter 7 Interest Rates And Bond Valuation Flashcards - Quizlet A bond that is payable to whomever has physical possession of the bond is said to be in: A. New-issue Condition B. Registered Form C. Bearer Form D. Debenture Status C. Bearer Form Jason's Paints just issued 20-year, 7.25 percent, unsecured bonds at par. These bonds fit the definition of which one of the following terms? A. Note B. Discounted

Suppose you bought a bond with an annual coupon of 7 percent

Solved Suppose you bought a bond with an annual coupon rate Suppose you bought a bond with an annual coupon rate of 7 percent one year ago for $860. The bond sells for $890 today. a. Assuming a $1,000 face value, ... Answered: Suppose you bought a bond with an… | bartleby Suppose you bought a bond with an annual coupon rate of 7.8 percent one year ago for $901. The bond sells for $934 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. fin 300 Flashcards | Quizlet Bond prices. The Timeberlake-Jackson Wardrobe Co. has 7 percent coupon bond on the market with nine years left to maturity. The bonds make annual payments. If the bond currently sells for $1,038.50, what is its YTM? Bond Yields. Merton Enterprises has bonds on the market making annual payments, with 12 years to maturity, and selling for $963.

Suppose you bought a bond with an annual coupon of 7 percent. Suppose you bought a bond with an annual coupon of 7 percent Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. Option 1 Low Cost Option 2.87 USD Option 2 Custom new solution created by our subject matter experts GET A QUOTE rated 5 stars Purchased 7 times Completion Status 100% View Answer Question : Question Suppose you bought a bond with an annual coupon ... Question Suppose you bought a bond with an annual coupon rate of 8.8 percent one year ago for $911. The bond sells for $954 today. a. Assuming... Question Suppose you bought a condo and took out a 30-year, $100,000 amortized loan at a nominal rate of 8% with end-of-month payments. How much interest... Fin 311 Homework Questions 1 - 1. Suppose you buy a 7 percent coupon ... Suppose that today you buy a 7 percent annual coupon bond for $1,060. The bond has 10 years to maturity. You expect to earn a rate of percent on your investment. (Do not include the percent sign (%). Round your answer to 2decimal places. (e.g., 32.16)) b. Two years from now, the YTM on your bond has declined by 1 percent, and you decide to sell. Calculating Returns Suppose you bought a bond with an annual coupon of ... Calculating Returns Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year?

Chapter 10 Finance Flashcards - Quizlet To calculate the dollar return, we multiply the number of shares owned by the change in price per share and the dividend per share received. The total dollar return is: Dollar return = 270 ($82.84 - 76.33 + 1.45) Dollar return = $2,149.20 Suppose you bought a bond with an annual coupon rate of 7.8 percent one year ago for $901. Answered: Suppose you buy a bond with a coupon of… | bartleby Business Finance Q&A Library Solved Suppose you bought a bond with an annual coupon of 7 Question: Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today. a. Assuming a $1,000 face value ... 3 award 10 out of 1000 points Suppose you bought a 7 percent coupon ... 3. award: 10 out of 10.00 points Suppose you bought a 7 percent coupon bond one year ago for $860. The bond sells for $890 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? Total dollar return $ Total dollar return $ b.

Solved Suppose you bought a bond with an annual coupon rate | Chegg.com Question: Suppose you bought a bond with an annual coupon rate of 7.2 percent one year ago for $895. The bond sells for $922 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Suppose you bought a bond with an annual coupon rate of 7.5 percent one ... Suppose you bought a bond with an annual coupon rate of 7.5 percent one year ago for $898. The bond sells for $928 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year rbig8379 is waiting for your help. Add your answer and earn points. Expert-verified answer Parrain Answer: $105 Assignment 2.4.xlsx - Chapter 12 - Dropbox 2.4 Problem 1:... Purchase price a year ago = $970 Current bond price = $940 Annual coupon rate = 7% Face value = $1,000 Inflation rate last year = 3% With this information, we proceed with the calculation of the required. a) Total dollar return: = Current bond price - Purchase price a year ago + annual coupon = $940 - $970 + ($1,000 * 0.07) = -$30 + $70 = $40 Solved Calculating Returns [LO1] Suppose you bought a bond Calculating Returns [LO1] Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today.

Solved Suppose you bought a bond with an annual coupon of 7 Question: Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today. a. Assuming a $1,000 face value ...

Finance Unit 8 Flashcards | Quizlet The coupon rate is the stated nominal annual rate of interest that the bond will pay, and is set when the bond is issued. The amount of the periodic interest payment is determined by multiplying the bond's face, or par, value by the coupon rate. ... Suppose you buy a 7 percent coupon, 20-year bond today when it's first issued. If interest rates ...

Post a Comment for "38 suppose you bought a bond with an annual coupon of 7 percent"