38 a 10 year bond with a 9 annual coupon

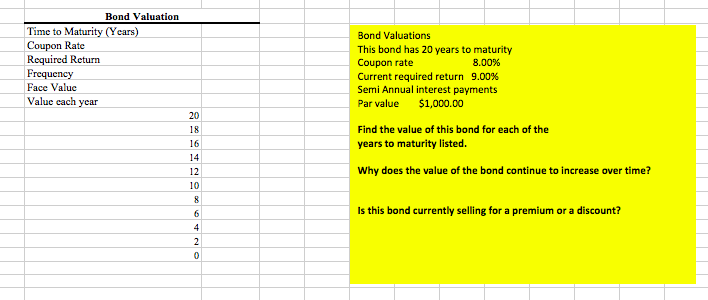

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is NOT … read more Neo 14,498 satisfied customers The Carter Companys bonds mature in 10 years have a par value

3. A 10-year corporate bond has an annual coupon of 9%. The… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more

A 10 year bond with a 9 annual coupon

Suppose you purchase a ten-year bond with 9% annual coupons. You hold ... answered Suppose you purchase a ten-year bond with 9% annual coupons. You hold the bond for four years and sell it immediately after receiving the fourth coupon. If the bond's YTM was 8.66% when you purchased and sold the Bond. 9 Municipal Bond Funds for Tax-Free Income | Kiplinger 09.04.2019 · The iShares National Muni Bond ETF (MUB, $110.67) is the biggest municipal bond ETF out there at more than $12 billion in assets, and it’s also the cheapest at a mere 0.07% in annual expenses. FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b.

A 10 year bond with a 9 annual coupon. Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total … Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). A 10 year annual coupon bond was issued four years 1.24 A 10-year annual coupon bond was issued four years ago at par. Since then the bond's yield to maturity (YTM) has decreased from 9% to 7%. Which of the following statements is true about the current market price of the bond? A. The bond is selling at a discount B. The bond is selling at par C. The bond is selling at a premium D. Diff E 13 A 10 year corporate bond has an annual coupon payment of 9 ... 16. You are considering investing in three different bonds. Each bond matures in 10 years and has a face value of $1,000. The bonds have the same level of risk, so the yield to maturity is the same for each. Bond A has an 8 percent annual coupon, Bond B has a 10 percent annual coupon, and Bond C has a 12 percent annual coupon.

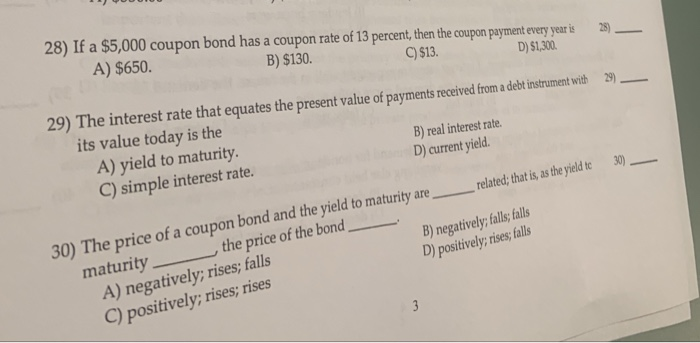

Duration Formula (Definition, Excel Examples) | Calculate Duration of Bond Let us take an example of a bond with annual coupon payments. Let us assume that company XYZ Ltd has issued a bond having face value of $100,000 and maturing in 4 years. The prevailing market rate of interest is 10%. Calculate the bond duration for the following annual coupon rate: (a) 8% (b) 6% (c) 4%. Given, M = $100,000. n = 4; r = 10% Question 12 a 10 year bond with a 9 annual coupon has Correct Answer: If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. 2 out of 2 points 2 out of 2 points Question 13 Bond A has a 9% annual coupon while Bond B has a 6% annual coupon. United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. How to Calculate Yield to Maturity: 9 Steps (with Pictures) 06.05.2021 · Plug values between 6 and 7 percent into the formula. Start with 6.9 percent, and decrease the annual interest rate amount by a tenth of a percent each time. This will give you a precise calculation of the yield to maturity. For example, when you plug in 6.9 percent (3.45 percent semi-annual), you get a P of 95.70.

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value This problem has been solved! A 10-year corporate bond has an annual coupon of 9%. The bond is ... A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? a. The bond's expected capital gains yield is zero. b. The bond's yield to maturity is above 9%. c. The bond's current yield is above 9%. d. If the bond's yield to maturity declines, the bond ... A 10-year corporate bond has an annual coupon of 9%. The bon The bon A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000)…. Show more A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? a. The bond's expected capital gains yield is zero. {C} b. OneClass: A 10-year corporate bond has an annual coupon of 9%. The bond ... 28 Nov 2020 A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? a. The bond's expected capital gains yield is zero. b. The bond's yield to maturity is above 9% c. The bond's current yield is above 9% d.

A 10-year bond with a 9% annual coupon has a yield to maturi A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling at a discount b. If the yield to maturity remains constant, the band's price one year from now will be lower than its current price c. The bond is selling below its par value. d.

9 of the Best Bond ETFs to Buy Now | Investing | US News 30.06.2022 · However, with a yield that is now roughly 60% higher than what it was just a year ago, it might be time to consider carving out a position once more in this $19 billion low-risk bond fund. Current ...

Chapter 7 Finance 310 Flashcards - Quizlet A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? a. If the bond's yield to maturity declines, the bond will sell at a discount. b. The bond's yield to maturity is above 9%. c. The bond's current yield is less than its expected capital gains yield.

A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more

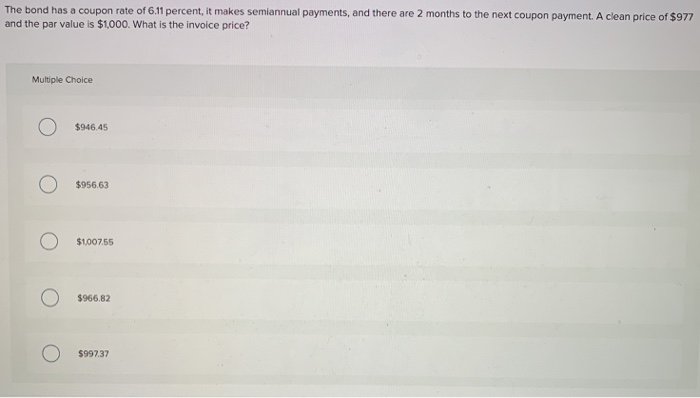

[Solved] A 10-year $1,000 par value bond has a 9% semiannual coupon and ... A 10-year $1,000 par value bond has a 9% semiannual coupon and a nominal yield to maturity of 8.8%. What is the price of the bond? Coupon A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

Post a Comment for "38 a 10 year bond with a 9 annual coupon"