42 bond yield vs coupon rate

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Bond yield vs coupon rate: Why is RBI trying to keep yield down? For example, if the price of the 10-year bond with fave value of Rs 1,000 and coupon rate of 6 per cent falls to Rs 600 in the secondary market, it will still fetch the interest of Rs 60 per year...

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity.

Bond yield vs coupon rate

Difference Between Coupon Rate And Yield Of Maturity The rate of interest is paid annually at a coupon rate. The current Yield defines the rate of return it generates annually. 3; Interest rate fluctuates in the coupon rate. The current yield compares the coupon rate to the market price of the bond. 4; The coupon amount remains the same till its maturity. Difference Between Yield and Coupon A company issues a bond at $1000 par value that has a coupon interest rate of 10%. So to calculate the yield = coupon/price would be (coupon =10% of 1000 = $100), $100/$1000. This bond will carry a yield of 10%. However in a few years' time the bond price will fall to $800. The new yield for the same bond would be ($100/$800) 12.5%. Yield to maturity - Wikipedia Coupon rate vs. YTM and parity. If a bond's coupon rate is less than its YTM, then the bond is selling at a discount. ... Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47.

Bond yield vs coupon rate. Understanding Bond Prices and Yields - Investopedia A bond's yield is the discount rate that can be used to make the present value of all of the bond's cash flows equal to its price. In other words, a bond's price is the sum of the present value of... How are bond yields different from coupon rate? - The F The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Difference Between Yield & Coupon Rate 2.Yield rate is the interest earned by the buyer on the bond purchased, and is expressed as a percentage of the total investment. Coupon rate is the amount ...

Bonds vs Bond Funds - Fidelity Oct 06, 2021 · Another key differentiator of individual bonds is that they give you the ability to buy into a fixed rate of return, or “yield,” at the time of purchase. By calculating the future cash flows—based on the bond’s coupon and principal—as a function of the purchase price, it is possible to derive a total return or yield to maturity—or ... Fed Funds Rate vs. US Treasury Yields | U.S. Treasury Bond = long-term bond yield The difference between 30- and 10-year bond yield may reflect inflation expectations over the long-term; 10- and 2-year bond yield spread, on the other hand, may reflect the direction of Fed's interest rate decision; 10- and 3-month bond yield spread may reflect current market liquidity. What is the difference between coupon and yield? - Quora The Coupon Rate is 9%. It pays $90 per year since it was issued $90 is 9% of the original $1000 investment. The Bond Yield (aka, Current Yield) is 10%. 10% is your return this year, if you buy the bond at today's prices $90 is 10% of your $910 investment. The Yield to Maturity (YTM) is 13%. It's the only number that really matters. Bond Yield Definition - Investopedia Jan 01, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Bond Yield Rate Vs Coupon Rate - TiEcon 2018 A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it normal balance generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

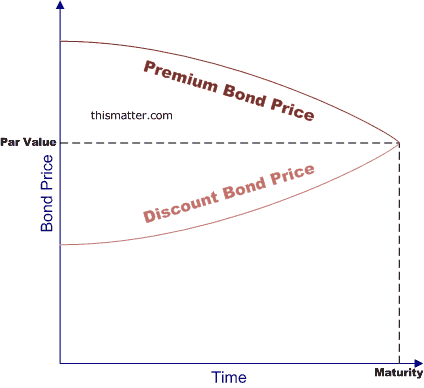

The Difference Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Yield - What is Yield? For A Stock, Bond, ETF, or Mutual Fund We won’t get into all the detail of this here, for now look at the two highlighted areas. In the top right we see the terms “Coupon” and “Maturity”.-Coupon represents the Yield of the bond at par value, or the price the bond was initially offered at which is usually 100. …

Coupon Rate vs Yield for a Bond: Fixed Income 101: Easy Peasy ... - YouTube This video addresses "Coupon Rate vs Yield" for a Bond in a simple, kid-friendly way. PLEASE SUBSCRIBE (It's FREE!): ...

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

Yield to Maturity vs Coupon - Australian Bond Exchange Every bond will show you their associated coupon rate. But you also need to investigate more than just the coupon rate. The yield to maturity is used to understand how your portfolio will be impacted overall by the investment in the bond. Unfortunately the yield to maturity measure changes through the life of the bond based on market factors.

Difference Between Bond Yield And Coupon Rate The main difference between Bond Yield and the Coupon rate is that Bond Yield is the return rate, whereas the Coupon Rate signifies the rate of interest to be paid annually. In simple terms, a bond's coupon rate shows the substantive interest merited on the bond. Bond Yield, or commonly known as Yield designates the revenue return on the bond.

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value...

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Post a Comment for "42 bond yield vs coupon rate"